Supply chain finance is a relatively new financing option that has recently gained popularity. Also called reverse factoring, supply chain finance allows companies to improve their cash flow by using their accounts receivable as collateral.

In essence, supply chain finance provides working capital to suppliers to continue production without waiting for buyer payment. The buyer then pays the lender back over time with interest. This can be a win-win situation for both buyers and suppliers. It can help buyers get the needed products while allowing suppliers to receive payments earlier than they would if they were waiting for traditional payment terms.

Supply chain finance has several benefits, including improved cash flow, increased efficiency and transparency, and reduced costs. In addition, supply chain finance can help build relationships between buyers and suppliers and improve supplier management overall.

According to a recent Moody’s Investors Service report, the global supply chain financing market grew by 35% in 2016 to reach $1.1 trillion. Trends show no signs of slowing down – the report forecasts that the market will grow by another 20% in 2017.

Some of the biggest companies are already using supply chain finance to improve their cash flow and business operations. For example, Walmart’s $12 billion supply chain finance program covers over 10,000 suppliers in 18 countries. And Coca-Cola has a $3 billion program covering over 1,000 suppliers in over 50 countries.

How Sudoers Supply Chain Financing work

Supply chain financing is short-term funding that helps businesses close the gap between when they incur expenses and when they receive payments. It’s a way to free up working capital so companies can invest in growth or take advantage of early payment discounts.

It funds businesses to purchase inventory and raw materials and then sell finished goods to customers. The funding is typically in the form of a loan repaid over time as customers purchase goods from the business.

There are two main types of supply chain financing:

- Purchase order financing

- Invoice financing

Purchase order financing is short-term funding that helps businesses pay for goods or services before they receive payment from their customer. Businesses typically use this type of funding with large orders but may not have the cash flow to pay for the goods upfront.

Invoice financing is a type of short-term funding that allows companies to sell unpaid invoices to a third party at a discount. This provides the business with an immediate infusion of cash which can be used to pay for expenses or invest in growth.

Step 1

The first step in either type of supply chain financing is to fill out an application with a lender. The lender will then review the business’s financial history and creditworthiness to determine if they are eligible for funding. If approved, the business will then enter into a contract with the lender outlining the terms of the loan agreement.

Step 2

Once the contract is in place, the business will purchase inventory or raw materials and then sell finished goods to customers. As customers make payments, the company will repay the loan to the lender, plus any fees and interest that may be due.

Supply chain financing can be a helpful tool for businesses that need working capital to grow or take advantage of early payment discounts. Understanding the terms of the loan agreement before entering into any financing arrangement is essential.

Difference Between Purchase Order Financing And Invoice Financing

Various types of financing are available to businesses to help them manage their supply chain and other operations. Two of the most popular methods are purchase order financing and invoice financing. While both have their advantages and disadvantages, it is essential to ascertain the difference between the two to choose the ideal option for your business.

Also Read: Know Essential Components Of Supply Chain Management

Purchase Order Financing

Purchase order financing is a short-term loan used to finance the cost of raw materials or goods ordered from suppliers. The loan is typically repaid once the goods have been sold to customers.

This type of financing can benefit businesses with large orders that may not have the cash to pay for them upfront. It can also be helpful if you need to place an order quickly and cannot wait for traditional funding sources, such as bank loans, to come through.

However, it is essential to note purchase financing can be expensive due to diligence fees. You may also be required to provide collateral to qualify for a loan amount that covers the entire cost of your purchase order.

Invoice Financing

Invoice financing is a short-term loan that businesses can use to free up working capital bound in unpaid invoices. With this type of financing, businesses sell their invoices to a third-party lender at a discount to receive an immediate infusion of cash. The loan is typically repaid over time as customers make payments on their invoices.

This type of financing can be beneficial for businesses with a steady stream of incoming invoices but may not have the cash flow to cover their expenses. It can also be helpful if you need quick access to cash and cannot wait for customers to pay their invoices in full.

However, invoice financing can also be expensive, and the fees charged by lenders can vary widely. You should also be aware that some lenders may require you to bring collateral to qualify for financing.

Explain The Examples of Supply Chain Financing

Supply chain finance is a general term referring to several financing activities and arrangements. In general, supply chain finance (SCF) refers to any type of financing used to fund the operations of a company’s supply chain. This can include inventory financing, accounts receivable financing, and even funding for raw materials and other inputs.

There are several different ways that companies can finance their supply chains. One common method is the use of factoring. Factoring is when a company sells its AR (accounts receivable) to a third party at a discount to raise cash quickly. It can be an effective way to finance inventory or other short-term needs.

Another common form of SCF is the use of letters of credit. Letters of credit are often used to finance international shipments of goods. They work by providing the buyer with assurance from the bank that the seller will receive payment for the goods shipped. This guarantees that the buyer will receive the goods as promised and helps to reduce the risk for both parties involved in the transaction.

There are many other types of SCF arrangements that companies can enter into. The best way to determine which financing is right for your company’s needs is to speak with a financial advisor specialising in this area.

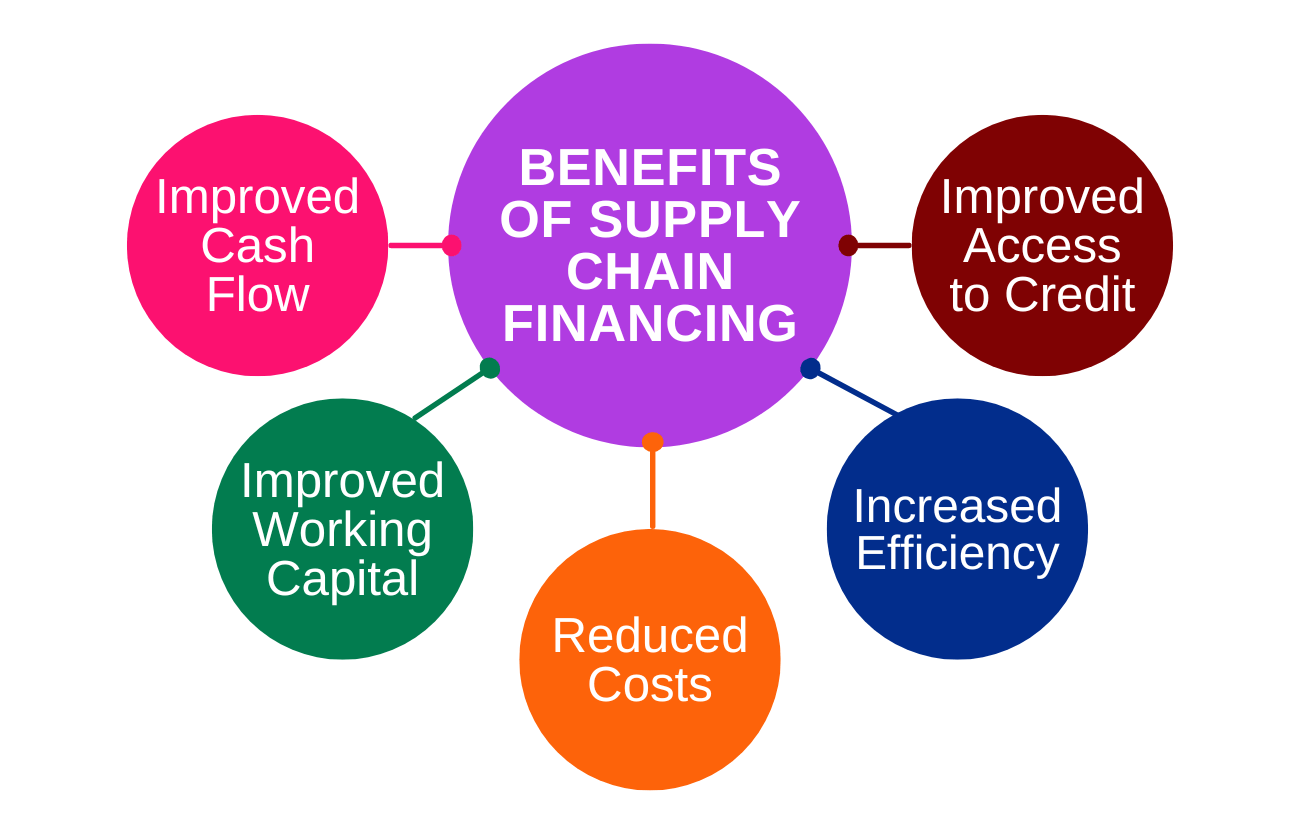

Benefits of Supply Chain Financing

Supply chain finance is financing that helps businesses in the supply chain manage their cash flow and improve their working capital. There are many benefits to using supply chain finance, including the following:

- Improved Cash Flow: Supply chain finance can help businesses in the supply chain manage their cash flow by providing financing for inventory and other goods. This can help businesses keep their operations running smoothly and avoid disruptions due to a lack of funding.

- Improved Working Capital: Supply chain finance can also help businesses improve their working capital by providing funds for inventory and other goods. It can free up funds to be used for other purposes, such as expansion or investment.

- Reduced Costs: Supply chain finance can help businesses reduce their costs by providing financing at lower rates than traditional funding sources. This can save businesses money and allow them to reinvest those savings into other operational areas.

- Increased Efficiency: Supply chain finance can help businesses increase efficiency by streamlining the financing process and reducing the time needed to secure funding. It can allow companies to focus on other operations and improve overall performance.

- Improved Access to Credit: Supply chain finance can also improve businesses’ access to credit by providing financing that is not tied to traditional sources of credit, such as banks or lines of credit. This can give businesses more flexibility in how they use credit and improve their chances of securing funding when needed.

How To Apply Supply Chain Financing in A Business?

Supply chain finance is an umbrella term for various financing techniques businesses can use to improve their cash flow and working capital. By using supply chain finance, businesses can free up cash that would otherwise be tied up in inventory or accounts receivable and use it to fund other areas of their business.

There are a few various ways that businesses can apply supply chain financing in their business. One common way is through invoice financing. With this method, companies sell outstanding invoices to a third-party lender for immediate cash in exchange. The lender then collects the payment from the customer on behalf of the business. This can be an excellent way for businesses to free up cash that would be tied up in receivables.

Another way businesses can apply supply chain financing is through Letters of Credit (LCs). LCs are issued by banks and guarantee that a buyer will receive the goods they have purchased from a supplier. This type of financing can help reduce the risk of non-payment by the buyer and also help improve the supplier’s working capital position.

There are many other ways that businesses can apply supply chain financing in their business. Each situation is unique, so it’s crucial to work with a financial advisor to ascertain the best method for your company’s specific needs.

How Important Is Supply Chain For A Thriving Business?

Supply chain finance helps businesses manage their supply chain costs and risks. It can finance the purchase of raw materials, finished goods, or other inventory items. Supply chain finance can also help businesses manage their accounts receivable and account payable.

Supply chain finance can be an essential tool for businesses of all sizes. Small businesses may benefit from supply chain finance because it can help them access working capital. Supply chain finance may benefit large businesses because it can reduce overall costs.

Also Read: How to formulate Advanced Supply Chain Strategy?

What Are The Current Trends In Supply Chain Financing?

Supply chain financing is a type of financing that helps companies finance their supply chain operations. It is a way for companies to get funding for their supply chain activities, such as purchasing raw materials, manufacturing products, and shipping them to customers.

There are a few various types of supply chain financing, but the most common one is called “reverse factoring”. Reverse factoring is when a company sells its receivables (invoices) to a financial institution at a discount. The financial institution then pays the company upfront for the receivables, and the company uses that money to finance its operations.

Reverse factoring is becoming more popular because it allows companies to get funding without debt. And it can be less expensive than other financing types, such as lines of credit or loans.

Another type of supply chain financing is called “letter of credit” financing. This is when a company gets a letter of credit from a bank to guarantee payment for goods or services it has purchased. The letter of credit gives the company some security that it will receive payment, even if the buyer does not pay on time.

Letter of credit financing can be high-priced, but it can be worth it for companies that are buying high-value items or services and need the extra protection.

Supply Chain Finance Vs Trade Finance: What is The Difference?

There are some key ways in which supply chain finance (SCF) and trade finance (TF) differ. For one, SCF is generally used to finance the entire supply chain, while TF is usually only used to finance trade transactions.

Additionally, SCF often involves more parties than TF, as it encompasses the financing provided by suppliers, manufacturers, and other logistics providers involved in the supply chain.

Finally, SCF typically has a longer-term focus than TF, as it aims to improve businesses’ cash flow and working capital by providing financing throughout the supply chain.

Best Practices of Supply Chain Financing

There are some principles to optimise your supply chain financing program include:

- Establish clear objectives and KPIs for your program.

- Work with a financing partner that understands your business and has experience in your industry.

- Make sure your invoices are accurate and up to date before submitting them for financing.

- Take advantage of early payment discounts when possible.

- Review your financing program regularly to ensure it is still meeting your needs.

Conclusion

Supply chain finance is a complicated topic, but it doesn’t have to be once you understand what it is and how it works. If you’re considering using supply chain finance for your business, make sure to do your research and work with a reputable provider. This financing can benefit both companies and investors, providing a way to improve cash flow and access capital.

If you want to learn more about supply chain finance, consider our Advanced Certificate in Operations, Supply Chain and Project Management. Our course will provide you with the skills and knowledge to develop a successful career in this rapidly growing field. You’ll get an overview of various financial topics, such as financial planning, budgeting, forecasting, and business performance analysis. You’ll also learn about supply chain finance and its impact on operations.

More Information:

What is Green Supply Chain? An Overview

Green Supply Chain Management: What It Is and Why It Matters?